Quick Tips

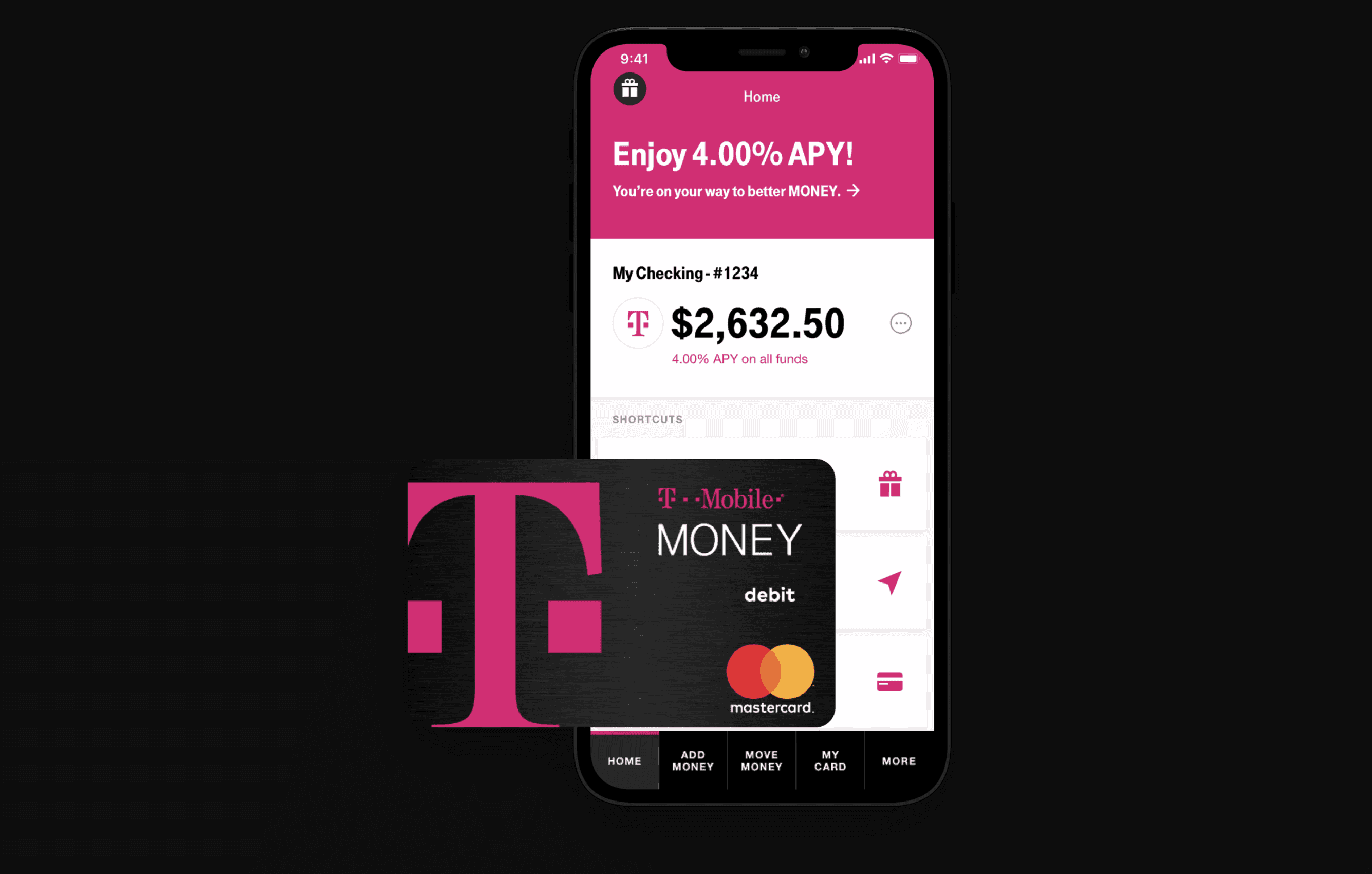

T-Mobile’s New Bank Account Offers Customers Up to 4% APY

Well this came out of left field. Last week, T-Mobile — a wireless service provider you may recall I recently switched to — announced that it was launching a new bank account. While the main features of this account are available to most Americans, the biggest selling point for current customers is the potential to earn 4% APY. Of course, there are a couple of asterisks to that offer, so let’s take a closer look at what T-Mobile is pushing.

Before we dive into that 4% tease, there are a few other things T-Mobile Money has going for it. For one, the account carries no monthly fees, minimum balance fees, or overdraft fees and offers free access to more than 55,000 ATMs thanks to the Allpoint network. Plus, all account holders are eligible to earn 1% of their funds. That’s all fairly in line with what other online-only banks offer, but is appealing nonetheless. However, it’s the extra perks for those with T-Mobile service that really stand out.

Currently, T-Mobile says that all of its post-paid customers (in other words, those with pre-paid accounts are not eligible) can earn 4% APY on T-Mobile Money balances of up to $3,000. That said, to score that interest, you’ll need to also deposit at least $200 a month. As for what happens to your interest rate over three grand, you’ll earn 1% APY on every dollar over $3,000 while still retaining that 4% on the first $3,000. Put another way, you’re overall APY will get diluted as your balance grows, with a $5,000 account balance generating an effective APY of 2.79%. For the record, that’s still near the tippy-top of what other online savings accounts boast.

Another perk for T-Mobile customers (that I wouldn’t plan on using) is their “Got Your Back” protection. This will allow accountholders to overdraft their accounts by up to $50 without penalty as long as they bring their balance back into positive territory within 30 days. What happens if you fail to do so? Well, that part’s actually not clear — but it’s probably best not to find out.

Having become a T-Mobile customer just a few months ago, I’m definitely intrigued by the proposed offerings of T-Mobile Money. At the same time, the question I find myself wondering the most about this offering is how long that $200 monthly deposit needs to stay in your account to qualify for the 4% APY. Ideally, I’d like to make that transfer, leave it just long enough, and then send it off to somewhere that it could earn more than 1%. Even with that big question, I suspect I’ll be giving in and signing up for T-Mobile Money any day now — will you?

Leave a Reply

You must be logged in to post a comment.

This seems to be a good deal but as you have said you need to be a post paid customer to avail this perks.