Saving Money

Tighten Your Budget: 5 Achievable Ways to Save More and Spend Less

Contrary to popular belief, a budget isn’t really something you can just (to borrow a phrase from Mr. Popeil) set and forget. The truth is that, from time to time, it’s worth reviewing your budget in its current form to see where you can make adjustments. More than just saving extra money for the sake of saving, this practice will allow you to divert cash away from things you don’t really care about and send it towards larger money goals — whether that means taking an epic trip, buying a house, or paying down those damned student debts.

If you’re striving to tighten budget to help build your savings, here are five tips for making that happen with as little pain as possible.

5 Tips to Tighten Up Your Budget

Cancel unneeded subscriptions

These days there are several streaming services vying for your attention and, more importantly, dollars. For a minute there it seemed like the trend of “cord cutting” would save people money but, as more options flood in, TV junkies and film buffs may be feeling the temptation to sign up for each and every one. Of course, if you’re really looking to make some room in your budget, putting a stop to this is a logical place to start. In some cases, you may just be able to cancel your subscription for a limited time and return to it later (like when Games of Thrones returns to HBO). Personally, my wife and I also enjoy making these big series runs into a true event by gathering at a friend’s house to all watch it together.

Although streaming services may be the biggest culprit causing leaks in your budget, there are likely other subscriptions you have in place that you just aren’t getting much value out of anymore. To locate these, you can try an app like Clarity Money that can not only identify recurring subscription fees but also help you cancel the services in question. If you want to be more thorough in your investigation, you can also review your recent credit card statements to find any you may have missed — including those sneaky annually-charged ones. Finally, for those subscriptions, you don’t end up canceling or any new ones you might add along the way, it’s always a smart idea to keep a master list of what the membership is for, how much it is, and which credit card it’s charged to. This will come in handy when making future cuts, as well make it easy to update your payment info as cards expire.

Hit up your local library (or their app)

Hit up your local library (or their app)

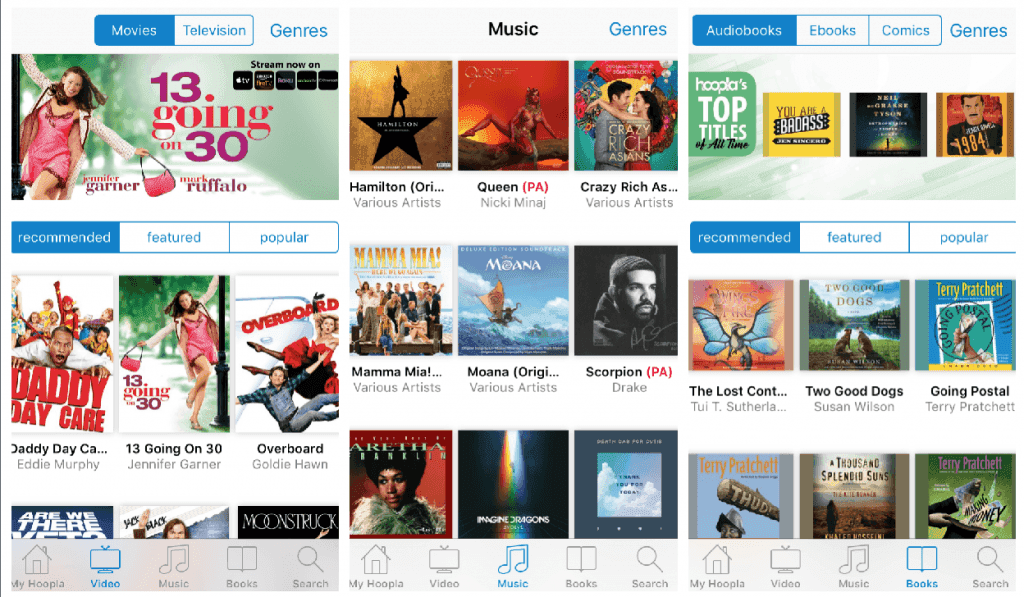

Lest you think that giving your Netflix subscription the kibosh will mean the end of all your entertainment, perhaps you should pay a visit to your local library. No, I’m not suggesting that you boycott screentime and do nothing but read from here on out — I’d just like to point out how many libraries have stepped firmly into the 21st century to offer a number of free entertainment options. In addition to physical media such as DVDs and CDs that can often be found at your local branches, your library system may be partners with apps such as Hoopla.

What is Hoopla? Basically, it’s an app and website that gives you access to ebooks, audiobooks, music, movies, and television — all of which can be enjoyed for free with your library card. Better yet, the content on Hoopla isn’t just obscure, low-budget, or *gasp* educational. Instead, you can currently borrow Drake’s new album, stream the feel-good Jennifer Garner/Mark Ruffalo flick 13 Going on 30, or binge the 90’s Must See TV comedy 3rd Rock from the Sun. While there are limits to how many items you can borrow each month, it will hopefully fill that Netflix-sized hole in your heart, while also introducing some variety to your media consumption.

Find “splurging compromises”

Realistically, no one (or at least very, very few among us) can go through life spending money on only pure essentials. As a result, most of our discretionary spending could likely be considered a splurge in some sense. When you’re trying to slim your budget and save a little extra, sometimes the key isn’t to slash some of these indulgences entirely but to reach a compromise of sorts.

As anyone who’s read this site with any sort of frequency is likely aware, I’m a big fan of Starbucks. Yet, once my mother gifted us with a Keurig this past Christmas, suddenly my trips to the Bucks (as we in the know call it) were reduced as I started finding it easier to brew a cup at home. Could I save even more by using a regular coffee maker instead of buying the comparatively expensive K-Cups? Yes, but that’s why it’s a compromise.

Another potential way you could compromise with your spending is to find ways to save money when dining out instead of halting restaurant visits altogether. From surveying weekly specials to taking home leftovers, there are many ways you save money when eating out. These are exactly the types of tips and tricks my wife and I have employed that have allowed us to enjoy our weekly date nights and still stay on budget.

Plan out your meals to save money on groceries

Plan out your meals to save money on groceries

While we’re on the topic of food, just as there are ways to cut your bill when dining out, you can also find ways to trim your grocery spending as well. Not only can this involve using digital coupons, shopping sales, or patronizing discount grocers like Aldi, but you could also benefit from planning ahead. In fact, a common suggestion from frugal living advocates is to create a weekly or monthly menu before you go stock up on goods.

There are several reasons why having a meal plan mapped out can help you save on your grocery bill. For one, it will make it clear what items you’ll need to pick up, preventing you from buying other items “just because.” A similar benefit is that you can avoid waste by ensuring fresh items you’re buying, such as produce, are used in a timely manner. Lastly, planning ahead of time will allow you to install some variety to your meals, likely reducing the temptation to go out.

Returning to the idea of “splurging compromises,” you may also consider trying out one of the many culinary subscription services like Plated, Blue Apron, Hello Fresh, or others. Granted, these aren’t exactly the cheapest options, but — once again — could help add some excitement to your dining routine and save you money when compared to restaurants. It’s also worth noting that several grocery stores have also started getting in on the meal kit craze, so be on the lookout for these options as well.

Find a credit card that rewards you for “musts”

I’ve often talked about various ways to maximize credit card rewards, which can save you a ton of money when done correctly. The problem is that many of the categories that various cards reward the most tend to fall under the “want” category and not the “need.” That said, that’s not always the case.

Although things like travel, dining out, and entertainment are often the main focus of credit cards, there are those that carry hefty rewards for things like gas and groceries. Alternatively, you can try non-credit card solutions for saving a little extra on essentials, such as the Pay with GasBuddy debit card. Of course, you can also opt for a card that gives you a flat amount of cash back on everything, saving you the hassle of trying to compare multiple options.

Tightening your budget isn’t about depriving yourself of the things you like — it’s about being able to afford the things you love. Therefore, if you’re looking to cut back on your spending in order to save more, canceling unnecessary services, looking for alternative entertainment, finding compromises with your money, reducing your grocery bills, and choosing a credit card that rewards you in essential spending categories can go a long way in making some extra room in your budget. Now the only question is, what big-time money goal will your new budget help you reach?

Leave a Reply

You must be logged in to post a comment.

Cutting back on the unnecessary was my biggest savings. I totally agree that its not about depriving yourself but focusing on what is important.

Planning your meals not only save you added expenses of dining out, but also enables you to eat healthier. I limit my mine to only once a week.

Having a coffee maker for coffee lovers like me already saved me much for the past months.