Saving Money

Save Money on Bank Fees with These Online-Only Banks

It’s no secret that many Americans have a complicated relationship with banks. In many ways, they may just seem like a necessary evil people put up with for convenience’s sake. As a result, consumers tend to grin and bear it with the various fees they’re charged on a monthly basis. However, when we talk about fees and frustrations, we’re mostly talking about brick and mortar banks. Meanwhile, online-only institutions may not only offer lower fees but may even pay you to keep your money with them.

Online-only banks may not be quite as convenient as banks with branch locations, but technology is quickly closing the gap. Plus, while some might worry about turning over their cash to unproven startups, all of the accounts discussed below are FDIC insured (although some of the FinTechs featured utilize partner banks for this). So if you’re looking to save money by ditching your too-big-too-fail bank, these eight online banks — four of which I personally use myself — are some smart alternatives.

Note: All information including APY rates was accurate as of March 10th, 2022

7 Online-Only Banking Platforms I Personally Use

Discover Bank

Not only was Discover Bank the first online-only bank I joined, but it also is the one I use most. Admittedly, I was initially drawn to them mostly just because I already had a Discover credit card. However, I quickly learned Discover offers a number of perks without many of the fees that big banks charge.

There are many things I enjoy about my Discover accounts, starting with the high APY at the time (it currently sits at a better-than-average 0.50%). I also use the checking account frequently, using the free checks that came with my account to pay rent each month.

Of course, speaking of rent, there was that one time when I learned a hard lesson about postdated checks and ended up accidentally overdrafting my account. It was then that I was thankful for Discover’s First Fee Forgiveness program that reversed the penalty I incurred. Since then, Discover has actually done away with many of its fees altogether, ending the need for Fee Forgiveness in the first place.

Overall, I think Discover Bank is a good option for those looking for a solid online-only bank but are still looking for a name brand that’s been around a while. I should also note that their checking account comes with a debit card that earns 1% cash back on up to $3,000 in purchases per month. So, while it may not have the absolute highest APY on the market, Discover can still help consumers save and earn money versus a traditional bank.

Ally

Before I ultimately landed on a Discover Bank account, I considered Ally merely because it was one of the few online-only banks I had heard of before. With no maintenance fees or minimum balance fees, Ally did make a compelling case for itself. Oh, and it also carried one of the best APYs at the time and currently offers 0.5% APY. So, somewhere along the way, I opened Ally Checking and Savings accounts for myself as well.

In terms of checking, Ally also has an interesting set-up as it pays 0.1% APY on checking balances under $15,000 and 0.25% on balances over $15,000 (of course I don’t know why you’d keep $15k in a checking account if the savings has double the APY). Checking accounts also come with a debit card you can use at more than 43,000 in-network ATMs for free or get reimbursed up to $10 in ATM fees per statement cycle. With these features and more, there’s good reason why Ally remains a popular choice for those looking to ditch traditional banks but who aren’t quite ready to enter the world of FinTech.

Marcus by Goldman Sachs

A Marcus by Goldman Sachs account can be opened on their website, but as you’d expect that’s actually not how I was brought to them. Instead, my Marcus account came about after their bank purchased one of my favorite personal finance apps, Clarity Money. Sometime after the purchase, Clarity rolled out the option for users to upgrade their automated savings account to Marcus accounts… but later shut down Clarity Money and moved customers to their own app. Despite my slight bitterness, I still leave those automated transfers on for Marcus.

Currently, Marcus’s APY is a respectable 0.50%. However, one interesting aspect of the account is that they offer boosts to this rate if you refer friends. At the time of this writing, when you refer someone to open an account, you’ll both earn a 0.50% increase (for a 1% APY) for three months. Referring customers can earn this bonus up to five times per calendar year. As you’ll see, there are other options for earning 1% APY, but props to Marcus for this clever promotion nonetheless.

SoFi Money/SoFi Checking and Savings

As we transition from actual banks to FinTechs, let me mention a FinTech that only recently became an actual bank. Following their acquisition of Golden Pacific Bancorp, SoFi is now a nationally licensed bank. In turn, their former SoFi Money hybrid account has transitioned to SoFi Checking and Savings.

Let me say at the top here that I still think SoFi Checking and Savings is a solid choice. Users can earn up to 1% APY if they opt for direct deposit (it’s 0.25% APY otherwise), have access to Allpoint network ATMs, and can take advantage of other cool features. Alas, the account was a bit more attractive in the early days of SoFi Money when the company offered worldwide ATM reimbursement among other top perks.

With that said, it’s very exciting that SoFi is now SoFi Bank. In fact, I see the development being helpful for those who may have been on the fence about the offering before. So while it might not be as cool as it once was, there are some great pros to offset those cons.

Current

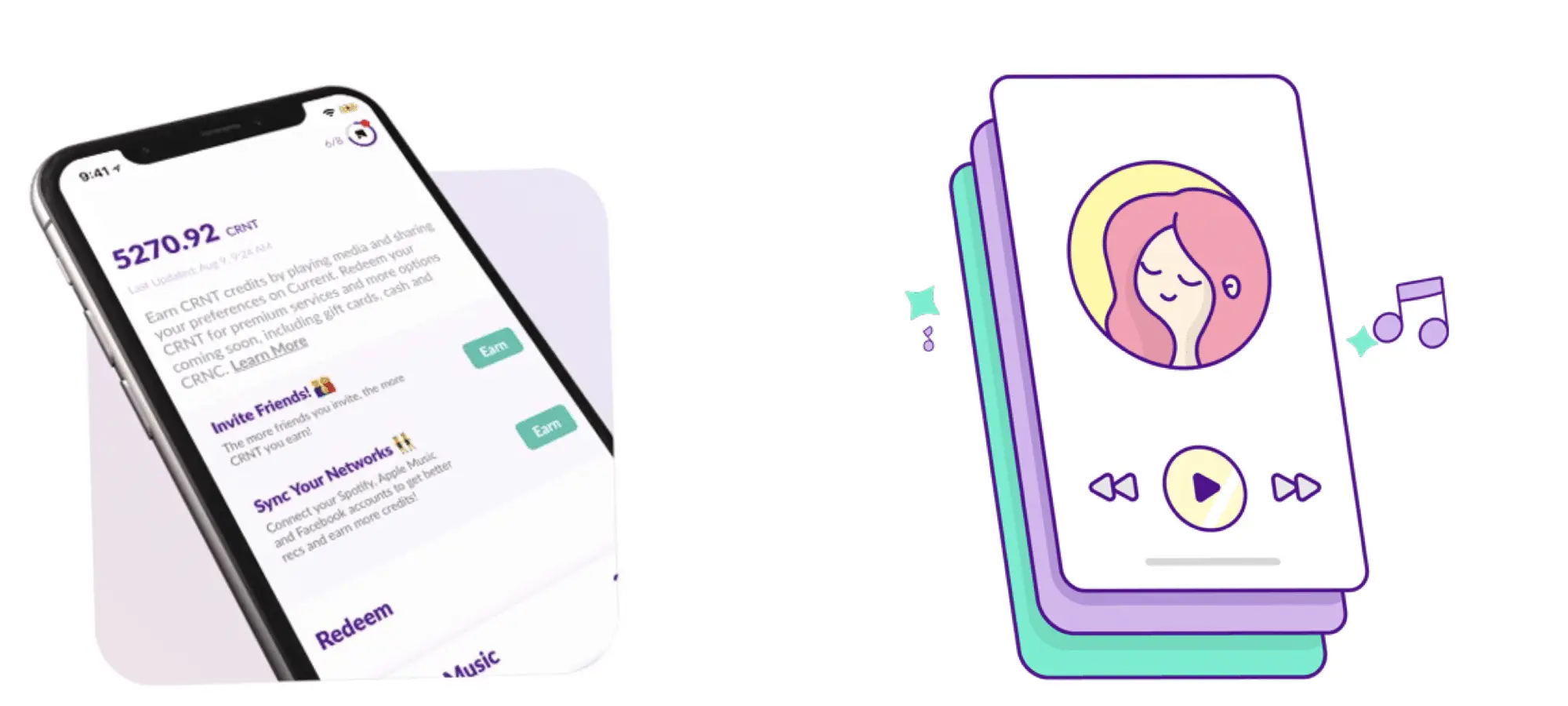

Another “neobank” I’ve become a fan of recently is called Current (which is not a bank but offers FDIC insurance through Choice Financial Group). However, while I thought that the app was sleek and had some cool features, the offering was lacking any paid interest. Luckily, the company has now changed that in a big way, allowing customers to earn up to a whopping 4% APY.

At this time, Current users can earn that 4% APY on up to $2,000 in funds placed into one of the app’s Savings Pods. The catch here is that, in addition to the $2,000 cap, customers with the free Basic account can only create one Saving Pod. Meanwhile, those who opt for the $4.99 a month Premium account can create up to three Savings Pods, enabling them to earn that 4% APY on up to a total of $6,000. What’s also kind of cool is that this interest is paid out daily. Thus, with the addition of this feature, Current is now an online option I’d recommend if you’re looking to earn interest.

T-Mobile Money

Speaking of 4% APY, another option for earning such a rate is with T-Mobile Money. In case you’re wondering, yes, this comes from T-Mobile, as in the telecom service provider T-Mobile. That said, you don’t need to be a T-Mobile customer to open one of these accounts.

Like many others on this list, T-Mobile Money doesn’t charge any fees and offers 1% by default. But wait — if you’re a T-Mobile customer, that APY could skyrocket thanks to a unique perk. Currently, T-Mobile post-paid customers who make at least 10 purchases a month with their T-Mobile Money debit card can earn 4% APY on balances up to $3,000. For balances over that amount, you’ll still earn 4% on the first $3k but get 1% on everything else.

Having switched to T-Mobile a few years back, I eventually signed up for T-Mobile Money to try to earn that 4% APY. Sadly, they changed their terms about a year ago, moving to the current debit card transaction requirement instead of basing the 4% APY on recurring deposits. Nevertheless, this is still one of my main accounts for parking funds since the 1% APY is better than most. Plus, when I think about it, I can still make a point to hit that 10 transaction limit and quadruple my monthly interest earning.

American Express Rewards Checking

Finally, I wanted to give a shout-out to the newest offering on this list, Amex Reward Checking. But, before I jump into what this has to offer, I should mention that it’s currently only available to American Express consumer credit card customers.

What makes this one unique is that the debit card earns Membership Rewards points. Specifically, you’ll earn 1 MR per $2 spent on the card. Then, points can be redeemed for deposits into your account at a rate of 0.8¢ per point. Alternatively, if you already have an MR-earning card, you can use your points for various other redemptions like you currently do.

In addition to this Member Rewards points perk, the account also earns 0.5% APY. Incidentally, that matches what Amex offers with its High-Yield Saving Account. On that note, if you’re not yet eligible for American Express Rewards Checkings, then perhaps that HYSA account may be worth looking into instead.

More Online-Only Banks to Consider

Synchrony Bank

If you’ve ever looked at lists of high-yield savings accounts, you’ve probably seen Synchrony near the top. That’s because the bank regularly pays one of the highest APYs in the space (at least among full-fledged banks and not neobanks). For example, they’re currently offering 0.6% APY with no minimum balance. The only problem is, that’s about all they have.

I was somewhat surprised to find that Synchrony doesn’t offer any kind of checking account (although they do have money markets if that’s something you’re interested in). It should also be noted that, while Synchrony’s APY is often impressive, it’s no longer unheard of as competition increases. For those reasons, while Synchrony still gets strong reviews, those looking for more of an all-around banking solution instead of just high-yield savings might want to look elsewhere.

Chime

Lately, I’ve been seeing a lot of commercials for Chime, so I figured I should include them on this list. Looking into them more, I was a bit surprised to find that they used to only pay 0.01% APY on savings. The good news is that seems to have changed, as they are currently advertising a 0.5% APY. Also good is that the service doesn’t charge many of the fees traditional institutions do, such as maintenance fees, service fees, or minimum balance fees.

Perhaps Chime’s biggest claim to fame (at least if their advertisements are any indication) is the ability to get direct deposit payroll funds up to two days early. Although the platform isn’t the only one to offer such a perk, there’s no doubt that it could be a nice feature for some. Is it cool enough to forgo more interest on savings, though? I’m inclined to say “no,” but that’s really up to you.

With their various fees and low APYs, chances are your brick and mortar bank account isn’t treating you right. If that’s the case, it may be time you looked online instead. Whether you’re just looking for respite from maintenance and monthly fees, want to earn cash back on debit card purchases, or want to help your savings grow even better thanks to high interest rates, these online banks and many others may just offer the perfect solution.

Leave a Reply

You must be logged in to post a comment.

Known Discover and Aspiration for quite a while but others on the list seem to offer good options depending on your needs.

With the perks it offers, these can be a good addition to your regular banks.

Though online-only banks are not as big as banks with physical branches, they can be convenient and also offers reasonable perks and features.

Great post! The SoFi Money product is interesting. A bunch of the guys in my office switched to SoFi Money recently.

I’ve been banking with Capital One 360 for years now. I’ve actually been a customer since Capital One acquired the online bank from ING Direct.

I love Capital One 360 because there are really no fees ever!

Good to know. I’ll check out Capital One 360 but I’ve become an even bigger fan of SoFi Money over the last few months.