Quick Tips

SoFi Money Makes Major Changes for New Customers

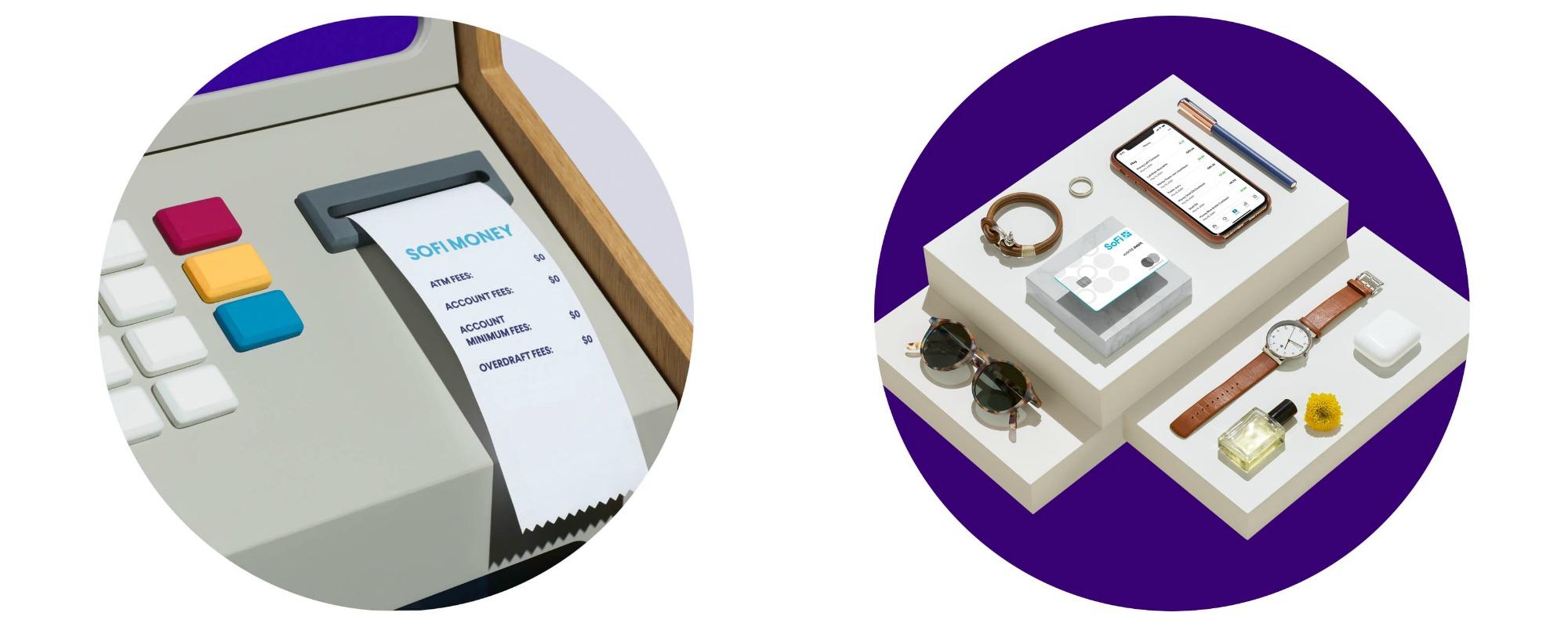

Several months ago, I came across the SoFi Money cash management account and quickly fell in love. With an impressive APY (at the time), other useful perks, and no fees, it ended up becoming my top account outside of my ancient Wells Fargo checking I still rely on for some reason. Sadly, it seems that those just coming to SoFi Money now might not have the same experience that I did all those many months ago. This week, SoFi quietly made some big changes to their account — including adjustments to their APY policies and ATM reimbursement.

We’ll start with the latter point as it’s not only how I first stumbled upon these changes but is also the bigger deal for me. Previously, SoFi Money allowed you to use any ATM in the world and have the fees reimbursed. This is a feature I’ve used several times and has honestly been a life-saver when traveling. Alas, SoFi has now switched to the Allpoint ATM network. While this means that customers will have access to more than 55,000 free ATMs, that’s not as good as “any.”

Upon discovering this update while scrolling SoFi’s homepage, I was ready to flip the table. However, after digging into the disclosures page in the app, I learned that this major policy adjustment will only apply to new customers. Meanwhile, those like myself who joined SoFi Money before June 8th, 2020 will retain the old reimbursement policy… at least for now.

On top of that, the account is also overhauling the way customers earn APY. Now, instead of earning the 0.20% APY by default, you’ll need to unlock that rate by depositing at least $500 a month. Otherwise, you’ll get a standard-yet-paltry 0.01%. This move would have been a much bigger deal before the slew of Fed rate cuts, but it’s still annoying nonetheless. Once again, those SoFi Money users who joined before June 8th, 2020 will be exempt from this change and will continue to earn to 0.2% APY regardless of their deposit habits.

To be fair, SoFi’s changes aren’t nearly as sweeping and egregious as I’ve seen from some other companies (*cough* Aspiration *cough*). Plus, they have been adding some interesting features to Money’s debit card, including cash back deals and offers. And, selfishly, I’m honestly quite relieved to be grandfathered into the old SoFi Money as the pain of losing another beloved financial product would just be too much for me — although, trust me when I say I’m now preparing for it. Bottom line: if you’re not already a SoFi Money user, the choice to sign up is no longer as much of a no-brainer as it once was.

As you just read I’m still a fan of SoFi Money but it gets even better. For a limited time you can get a $50 bonus if you open a new account with this Moneyat30 link.