Quick Tips

T-Mobile Money is Now Allowing Sprint Customers to Earn 4% APY Too

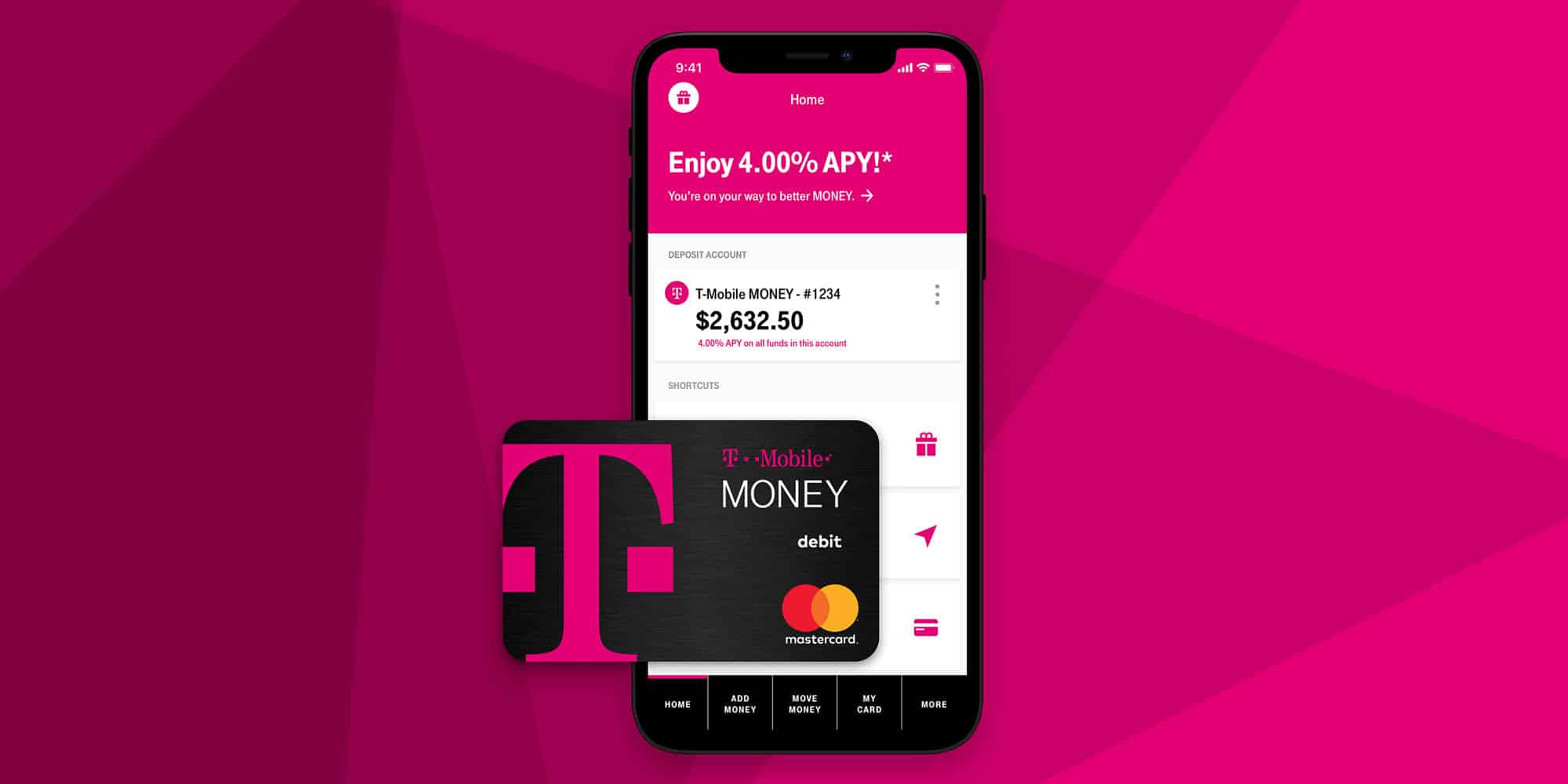

I’d have to imagine that most people reading this (at the least the ones based in the United States) are familiar with T-Mobile. In fact, I’d be willing to bet that a significant percentage of my readers are on T-Mobile or have been at some point in their lives. And yet, I’d also go out of a limb and assume that few have heard about the telecom’s digital banking service T-Mobile Money. If that’s the case, now’s a good time to get caught up on the offering as it now features up to 4% APY for both T-Mobile and Sprint customers.

In case you weren’t aware, T-Mobile and Sprint recently completed their long-in-the-works merger. As a result, little by little, the magenta company has been expanding some of its unique perks to Sprint users. This includes letting them in on the T-Mobile Tuesday fun and, now, the ability to earn interest on your savings that’s head and shoulders above what you can find nearly anywhere else.

With T-Mobile Money, those who are on T-Mobile’s post-paid plans can score 4% APY on their savings — which, to be clear, is amazing. However, in order to unlock that rate, you’ll need to deposit at least $200 a month into your account. Additionally, this 4% will only apply to the first $3,000 in your balance. Meanwhile, if you have more than $3k or don’t want to deposit $200 a month, you’ll earn a still respectable (especially these days) 1% APY.

As I mentioned, while this enhanced rate was previously only available to those on T-Mobile plans, now those on Sprint will also be able to take advantage of this offer. In terms of other perks, T-Mobile Money also doesn’t charge any fees and even has a “Got Your Back” overdraft protection feature. What’s more, even if you’re not a T-Mobile/Sprint customer, you can still open an account and earn 1% APY on savings (although some of the other features such as Got Your Back won’t be available).

Seeing as I’m already a T-Mobile user and haven’t been with Sprint in about a decade, this update doesn’t really affect me. That said, this news served as a reminder for me to finally open a T-Mobile Money account and start earning that 4% APY. In other words, watch out for a full review of the service over on Dyer News in the coming weeks.

While there’s plenty to debate when it comes to the question of whether or not the T-Mobile-Sprint merger is a good thing for consumers overall, this aspect of the deal could be beneficial for savvy Sprint users. With most big banks only offering 0.01% APY on savings and even many FinTech options topping out around 1% these days, the ability to earn 4% APY on savings is pretty phenomenal — even if it is only on a relatively small balance. Therefore, whether you’re a T-Mobile loyalist, a Sprint customer just now entering the fold, or anyone thinking of making the switch, it may be worth taking a closer look at T-Mobile Money as an auxiliary account to house your savings.