Quick Tips

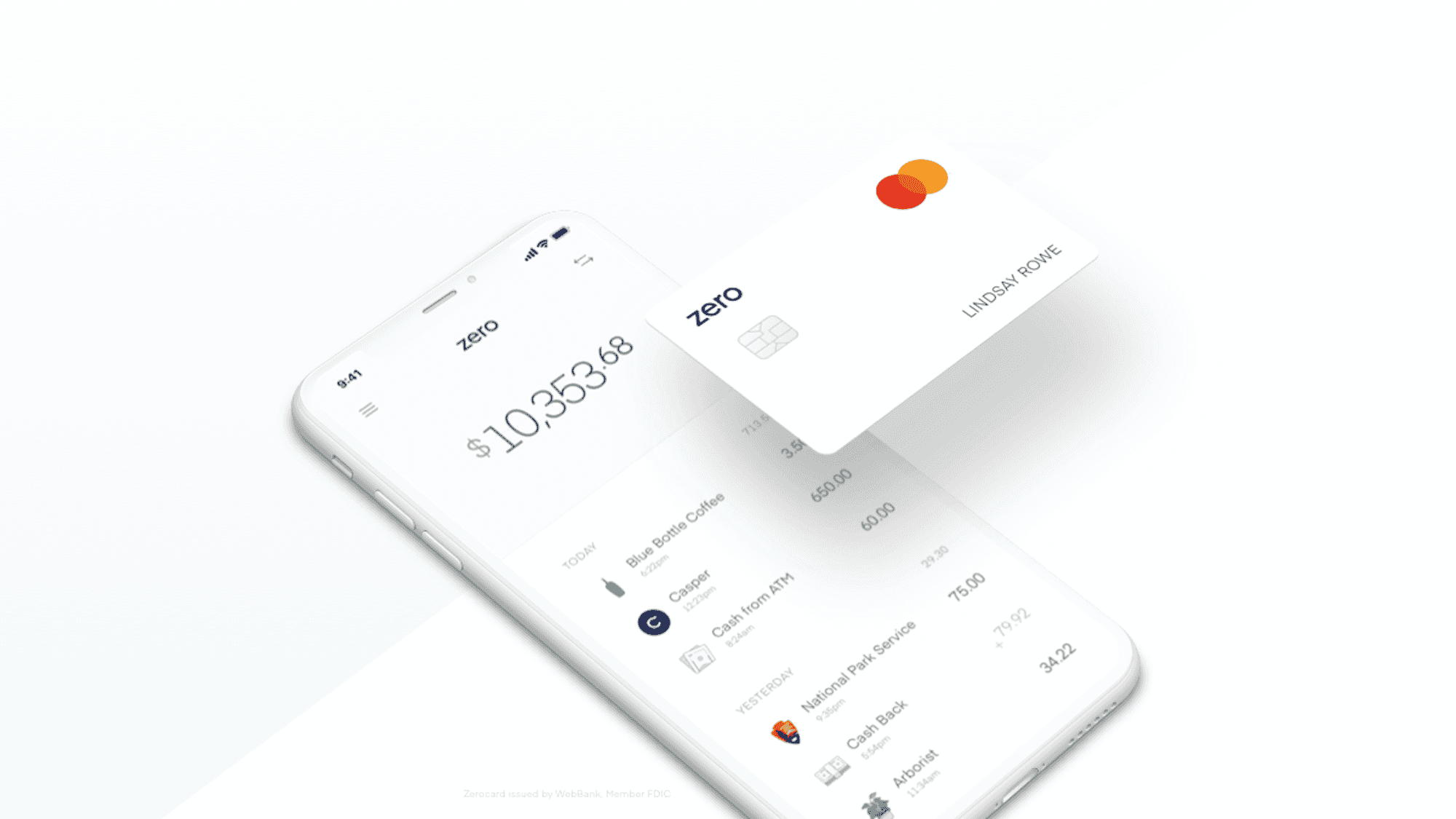

Zero Opens Its Debit-Style Credit Card to All

What if a credit card offered a “debit-style experience” that would help prevent cardholders from racking up debt? That’s the big idea behind Zero‘s new Zerocard. If that name and pitch sound familiar, it’s probably because Zero has been rolling out the product in recent weeks, working through the large waitlist that amassed before launch. Now, not only is the card available to all those who joined that waitlist but is also open to newcomers as well.

So what exactly does a “debit-style experience” entail? Although Zero is a credit card (with rewards to boot), purchases made using the Zerocard are displayed alongside users’ Zero Checking balances, helping them to ensure that they are able to pay off their card in full each month — and can even opt-in to do so automatically. In terms of other benefits, the card carries no foreign transaction fees and no annual fee, while Zero Checking is free of any maintenance fees.

How Zerocard Cash Back Works

As I mentioned, Zerocard does offer users cash back rewards — up to 3%, in fact. However, the structure of these rewards and how to obtain them is unique. First, there are four available in levels: Quartz, Graphite, Magnesium, and Carbon. These mineral-named tiers bear different cash back benefits in addition to exclusive card designs. Cardholders can reach these higher levels by referring friends to Zero. Alternatively, users with higher annual spending can move their way up the ranks as well.

Here’s how the levels break down:

Quartz

- Entry level

- Earns 1.0% cash back on purchases

Graphite

- Refer one (1) friend to Zero or have $25,000 in annual spending

- Earns 1.5% cash back on purchases and .5% in rewards annually*

Magnesium

- Refer two (2) friends to Zero or have $50,000 in annual spending

- Earns 2% cash back on purchases and 1% in rewards annually*

Carbon

- Refer four (4) friends to Zero or have $100,000 in annual spending.

- Earns 3% cash back and 2% in rewards annually*

*Annual rewards are based on average Current Position (daily Zero Checking minus Zerocard balance)

In a press release about the Zerocard’s big launch, Zero CEO and founder Bryce Galen explained the thought behind the card, saying, “Unlike big banks, Zero won’t tempt consumers to overspend their way into debt. Big banks are also built on highly outdated technology. We built Zero from the ground up with the latest tech, so we could give customers a more delightful and rewarding experience.” It’s also worth noting that Zerocard comes via a partnership with WebBank. Speaking on this joint venture, WebBank Executive Vice President of Strategy and Business Development. Jason Lloyd, said, “Today’s consumers are looking for a banking experience that empowers them, which is why we’re excited about Zerocard’s new approach to banking and rewards for the digital age. We’re looking forward to combining WebBank’s expertise and Zero’s technology to change the way consumers spend and earn rewards.”

If you’re interested in Zero, you can start by visiting their website or downloading their app. Keep in mind that since Zerocard is a credit product, it is subject to approval. But, for those who crave the benefits of a credit card with the financial restraint of a debit card, the Zerocard may just be a smart solution.