Quick Tips

Bumped Brings Back Its Loyalty Rewards Structure, But With a Twist

Last week, I bemoaned the death of another FinTech app I enjoyed while noting that it was far from the first time I’d had to do so. Yet, in the past couple of weeks, I’ve now experienced quite the opposite: the unexpected returns of previously-great tools. This delightful trend began with the rebirth of Long Game and now has continued with Bumped. If you’re not familiar, Bumped is an app I’ve been using for years in order to earn “stock back” while shopping. Unfortunately, last year, the tool saw a major overhaul as it moved from beta mode to its “1.0” model. Well, now a major part of what made Bumped great in its pilot days has been brought back to life, allowing customers to passively earn shares of stock in the companies they patronize.

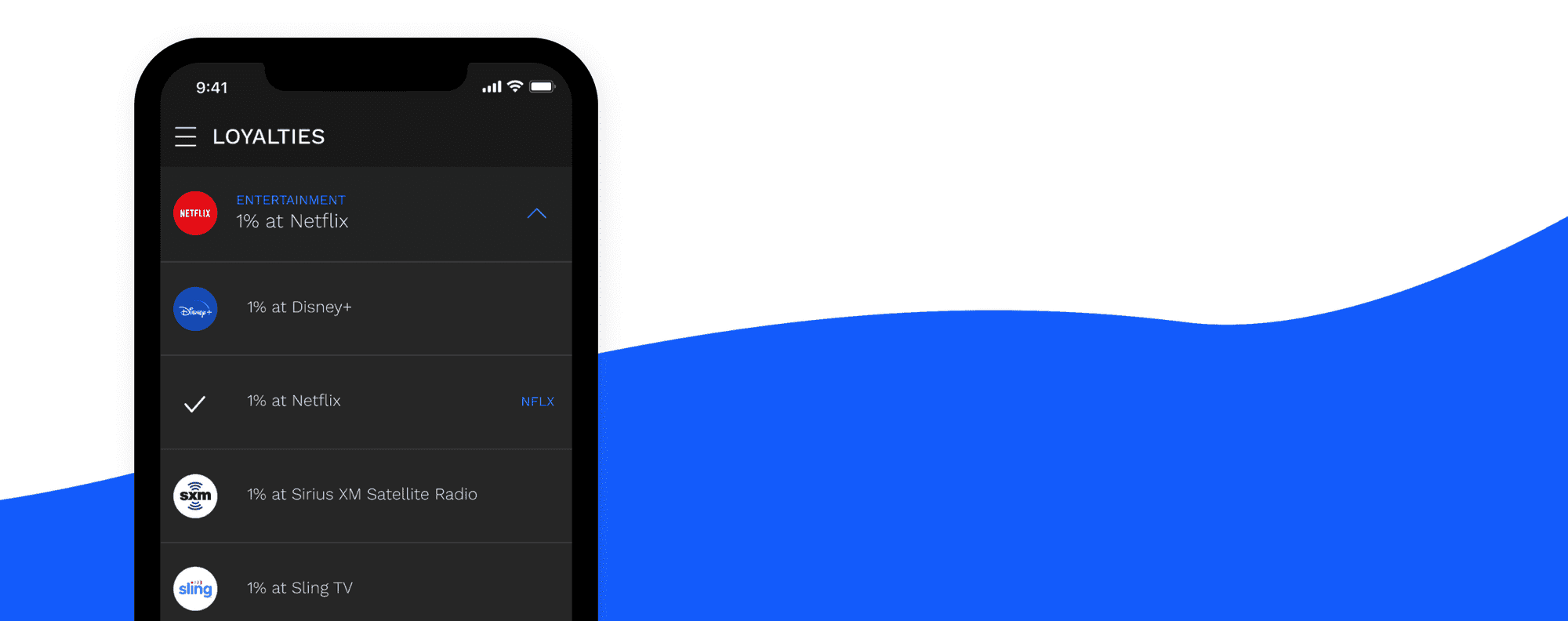

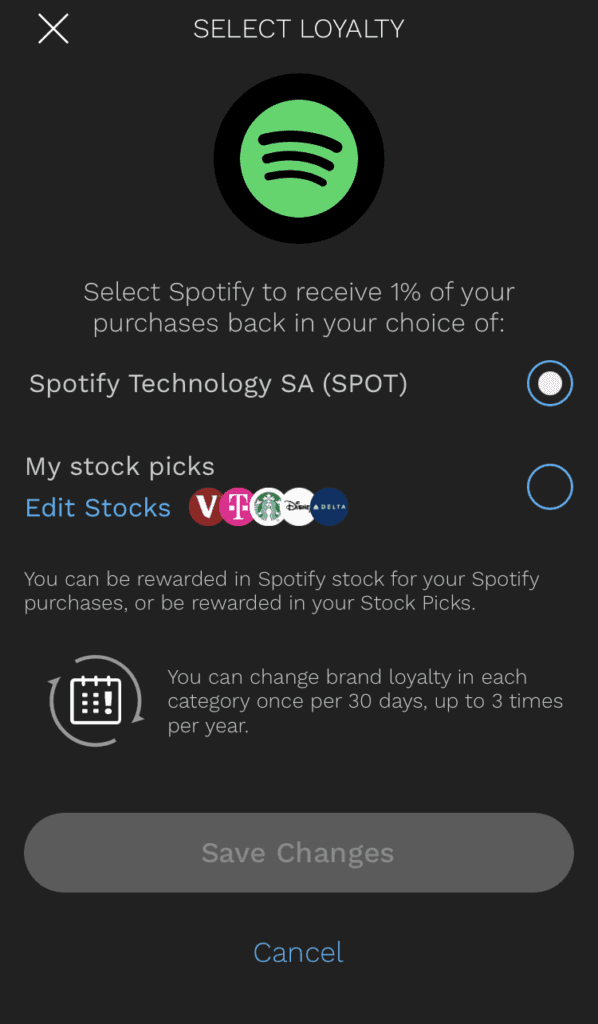

Without getting too into the weeds, let’s take a quick look at the re-launched Bumped Loyalty Rewards and how it compares to the original version — so, for a quick catch-up on Bumped 1.0, I’d recommend checking out my full review. To start, just like before, users are able to select one company in each of several categories to earn rewards from. Once selected, these picks can only be changed once per 30 days (meaning you’ll need to wait 30 days in order to change it) and only up to three times per year. What’s different this time around is that the number of categories has shrunk some while also mixing things up with new or reconfigured options

At this time, there are 10 loyalty categories:

- Apparel

- Club Warehouse

- Coffee

- Entertainment

- Meal Kits

- Personal Care

- Pet Supplies

- Quick Eats

- Sportswear

- Transport

Some of these overlap with previously available categories while others are new. Thus, while some of my selections were preloaded from the beta days, several required new selections. This also brings us to another change: users can opt to either earn stock in the selected company (or $VTI for some choices) or stick with the stock mix they set for their Stock Marketplace earnings. What’s nice is that you can set this choice for each selection.

After giddily making my selections, I then experienced a moment of terror. That’s because, when the move to 1.0 occurred, it seemed as though only Visa and Mastercards were supported. Considering my newfound Amex fandom and that Discover’s Q2 bonus category is warehouse clubs, I was worried that I’d need to sacrifice some rewards in order to earn with Bumped. Luckily, these fears were unfounded because, after navigating to the linked cards section of the app, I saw that all of my previous additions had returned! I was also able to easily add my Gold card to Bumped, which will definitely come in handy for a couple of the loyalty categories.

Now, as I alluded to, there is a bit of a catch with this return. While it looks as though customers will be able to earn Loyalty Rewards now through June 30th of this year, they’ll need to unlock these rewards in the future. According to Bumped, access to Loyalty Rewards will have “quarterly cadence.” In other words, users will need to complete a certain task in order to gain another three months of Loyalty earning. Currently, customers can earn a three-month extension by making at least one purchase in the Stock Marketplace. However, going forward, the app notes that the required actions may change.

Personally, while I’m slightly hesitant to see what future quarterly requirements there may be, I’m really excited about this development. As I acknowledged at the time of the change, the move to the 1.0 model was likely necessary to ensure the long-term viability of Bumped. Similarly, this latest move feels like a strong compromise that will hopefully satisfy some early adopters. I also give the company major props for staying true to their word and working hard to bring back a feature they knew customers loved. With that, I look forward to testing out the rejuvenated Bumped Loyalty Rewards and reporting back soon.

Leave a Reply

You must be logged in to post a comment.

Good news for Bumped users!

Maybe it’s time to consider adding Bumped into my apps list. Thanks for sharing your review.

I’m just as excited upon learning that Bumped is back as what we’ve known it for.