Quick Tips

Square’s Cash App is Testing Short-Term Loans — Is That a Good Thing?

It’s now been a few years since I first came across Square’s Cash app. At the time, I had already been familiar with Square’s card readers and POS machines that are a staple at many small businesses, so I figured I’d check out their peer to peer payment tool and even snap up one of their free debit cards. Since then, I’ve seen the Cash app evolve in a few ways — including expanding into stock trading. That’s why I was interested to hear about their latest potential feature: short-term loans.

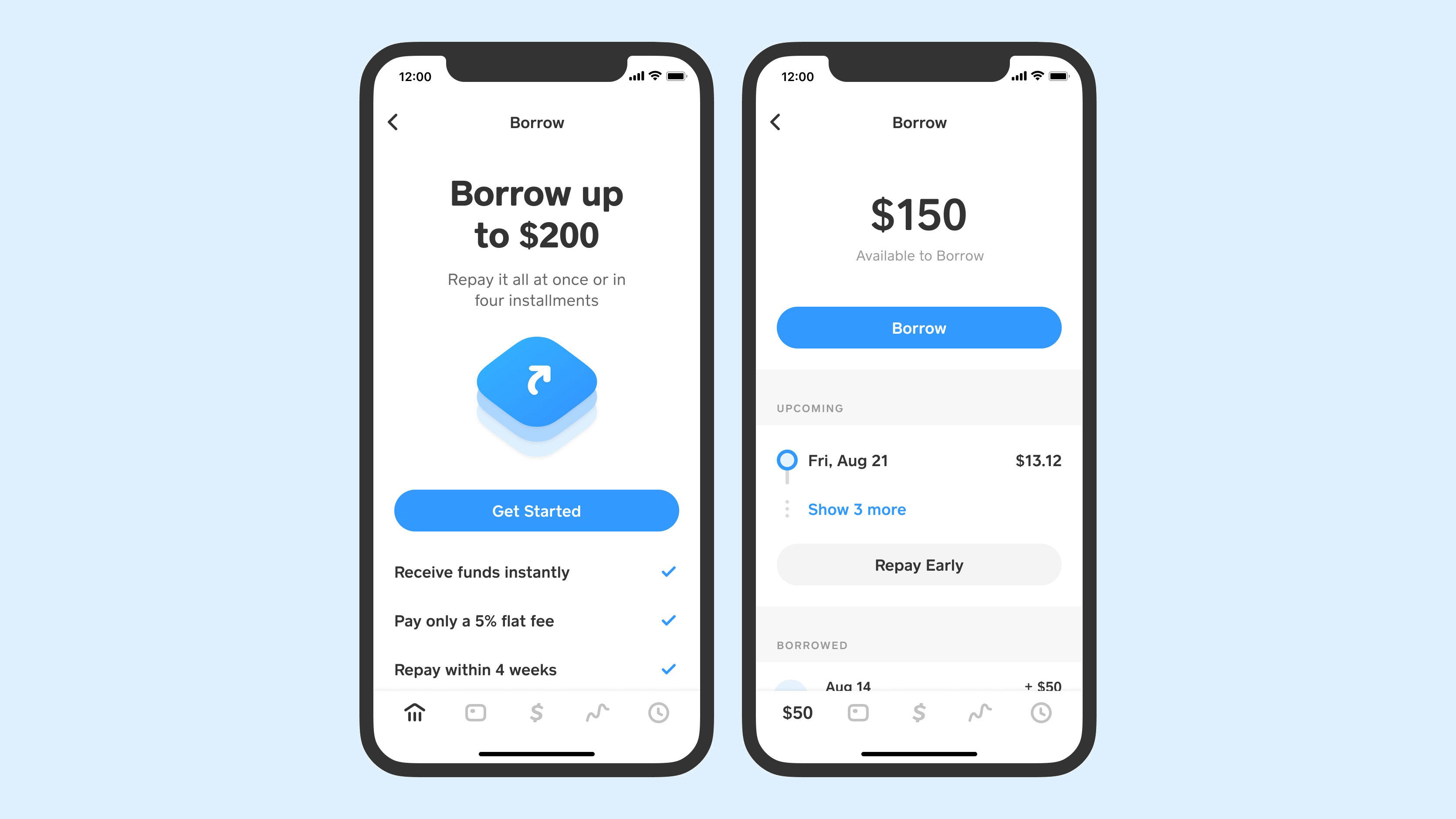

According to TechCrunch, the Cash App is currently in the midst of experimenting with the ability for select users to borrow between $20 to $200 for a flat interest rate. For this test, the fee is equal to 5% of the loaned amount. Users are expected to pay back these loans within four weeks — although an extra week of grace is apparently afforded to customers as well. However, should five weeks pass and a balance still be outstanding, 1.25% in non-compounding interest will be added with each passing week.

If you’re now checking your Cash app for this feature, you should probably know that the company says it’s currently only being offered to a mere 1,000 or so users. However, speaking to TechCrunch, a spokesperson said, “We look forward to hearing their feedback and learning from this experiment.”

It’s not exactly clear how long Square Cash has been planning this feature, but it definitely seems appropriate given the current circumstances. With Congressional leaders still at a standstill when it comes to cutting a deal, many Americans continue waiting on a second round of stimulus checks to help them stay afloat (see my recent UBI rant for more on this topic). To be clear, this is in no way a replacement for such assistance, but it could certainly come in handy for some users.

While 5% interest may not be great, it’s also not the worst option. Since the top loan amount is $200 at the moment, you’d end up paying $210 (assuming you paid it back on time or in the grace period). Again, that doesn’t sound so bad and, as TechCrunch notes, is a far cry from what some payday lenders would charge for a similar service.

Of course, one might wonder why you’d pursue this option instead of just making a necessary purchase with a credit card. After all, depending on the time of the transaction, you could potentially get more than four weeks of float time without paying any interest. The simple answer is that many Cash app users are likely without a credit card and unable to get one, making this point moot. On top of that, even if they do have a credit card, they may not be able to access cash from it — something they might need if they intend on using the funds for rent or other such expenses that might not allow for card payments.

Without having the chance to try out this feature for myself, it’s hard to say exactly how I feel about it. But, if nothing else, I’m at least intrigued by Square’s idea and tend to trust them as a company overall. Personally, I do think it sounds more helpful than predatory, yet I am admittedly not an expert on the subject. With that, I’d love to hear what anyone else thinks about this test and whether or not they believe the feature should move forward.